Comprehensive estate planning has several key components.

People have long valued knowledge.

It is natural to want to understand.

In fact, I feel most vulnerable when I do not even know what I do not even know.

And that encompasses too many areas to list!

How about you?

From the time children learn to speak, they are asking questions.

This only makes sense.

Why?

Taking action without knowing enough about something important can have dire consequences.

For this reason, people often avoid what they do not understand.

That is not only unfortunate, but can be catastrophic.

According to a recent The Street article titled “10 Essential Estate Planning Documents You Need,” this may account for the number of Americans who do not have an estate plan.

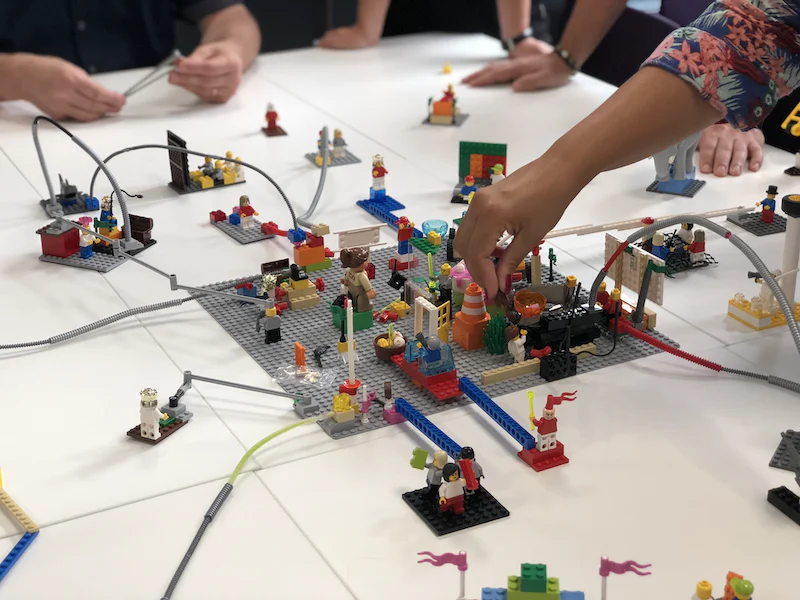

Similar to legos in a model kit, all estate planning components are important to a working estate plan.

If you feel clueless when it comes to estate planning, continue reading.

Estate planning involves making preparations for both certain death and potential incapacity.

So, what are several key components (in no order of primacy), when it comes to this essential personal responsibility?

Last will and testament.

A last will and testament is foundational in estate planning.

It serves several purposes.

First, the last will and testament the legal document is the primary legal document used to nominate guardians to rear any orphaned minor children you may have.

Second, you nominate an executor (also known as a personal representative) to "settle" your probate estate according to the instructions in your last will.

Finally, a last will distributes assets subject to probate when the probate estate is closed by the court.

Examples of these assets include personal belongings, bank accounts, investment accounts, digital assets, and houses.

You may determine the "objects of your bounty" in your last will among your family, friends, or charities.

Revocable living trust.

A revocable living trust is a created legal entity.

The trust governs the management and distribution of assets titled to the trust while you are living and/or received upon your death.

While you, the trustmaker (also known as the grantor, settlor, or trustor), are alive, you run the show according to the trust provisions unique to you.

Consequently, you can amend or revoke the trust, move assets in and out of the trust at will, and pretty much do whatever you please.

Upon your death, not only do trust assets avoid probate, but the revocable trust becomes irrevocable to carry out your distribution instructions.

Having greater speed and privacy when it comes to asset distribution is considered a significant benefit of a trust.

Beneficiary designations.

Beneficiary designations are important components to estate planning.

Unfortunately, they are often overlooked.

Certain assets have beneficiary forms to govern inheritance.

These commonly include retirement accounts and life insurance policies.

If you are divorced and fail to update your beneficiary designations, then your ex-spouse yet may be your primary beneficiary.

Yikes!

Advance Healthcare Directive (AHCD).

Some estate planning components involve incapacity planning.

One such document is the Advanced Health Care Directive.

Typically, both a health care treatment directive (living will) and durable power of attorney for health care decisions make up the AHCD.

With a health care treatment directive, you can provide guidance regarding medical care you would like to receive (or would like to forego) in the event you are unable to communicate.

Often this guidance addresses artificial respiration, types of treatments, and end-of-life care.

A durable power of attorney for health care decisions allows you to appoint a trusted individual to make health care decisions on your behalf should you become incapacitated.

General Durable Power of Attorney.

This document is the "kissing cousin" of the durable power of attorney for health care decisions.

Your appointed "attorney in fact" is empowered to manage property and funds on your behalf.

This person can authorize payments for medical expenses, pay bills, file your tax returns, and oversee other financial affairs.

Insurance policies and financial information.

Financial information has a variety of components.

Beyond bank accounts, brokerage accounts, and real estate deeds, it also includes life insurance, auto insurance, health insurance, home insurance, and long-term care insurance.

These polices should all be stored together for ease of access when needed.

You also should all of your financial accounts, to include how to access them.

Some people choose to store the list in an encrypted document on a computer while others prefer a simple notebook.

Proof of Identity Documents.

Your identity documents should also be stored securely.

These include Social Security cards, Medicare cards, birth certificates, marriage certifications, divorce certifications, discharge papers from the military, prenuptial agreements, divorce settlements, and passports.

Your executor or trustee may need these when you die and have ready access to them.

Titles and Property Deeds.

Because titles and deeds are proof of ownership, they are essential to estate planning.

You should inventory these and create a list.

If you create a trust and choose to transfer ownership to the trust, the titles and property deeds will need to be updated.

Like beneficiary designations, the names on these documents superseded the wishes in your last will.

If you and your spouse own your how as joint tenants with rights of survivorship (or as tenants by the entirety in Missouri), then your spouse will become the legal owner even if your last will stated otherwise.

Digital assets.

On average, most Americans under age 70 have 160 digital accounts.

Wow!

A password manager or secure digital vault may prove helpful in managing login credentials.

You should name a digital executor in your last will to manage or cancel accounts and to distribute digital assets to heirs.

Both Kansas and Missouri passed laws permitting this.

Funeral instructions.

Although funeral and memorial planning may not seem like important components of estate planing, your family will thank you.

By purchasing a burial plot and providing payment for your funeral in advance, you can save them stress when they are mourning your loss.

If you do plan your memorial service and funeral, you should record your wishes and share them with family members as well as provided copies of invoices for anything prepaid.

Many clients storing original copies of the estate planning components in a waterproof and fireproof box in their homes.

Even so, your appointed fiduciaries and loved ones also may benefit from having copies of these documents now.

Be sure to review all components of your estate plan every three to five years and update as needed.

Our rule of thumb is for our clients to do at least a "self-review" every two years.

Reference: The Street (Jan. 31, 2023) “10 Essential Estate Planning Documents You Need”

REMEMBER: “The choice of a lawyer is an important decision and should not be based solely upon advertisements.”

This statement is required by rule of the Supreme Court of Missouri.